Still stuck with manual reviews across onboarding, underwriting, and QC operations?

Turn fragmented data into decision-ready intelligence for lending teams.

Faster Decisions | Smarter Underwriting | Reduced Risks

High-Impact Use Cases

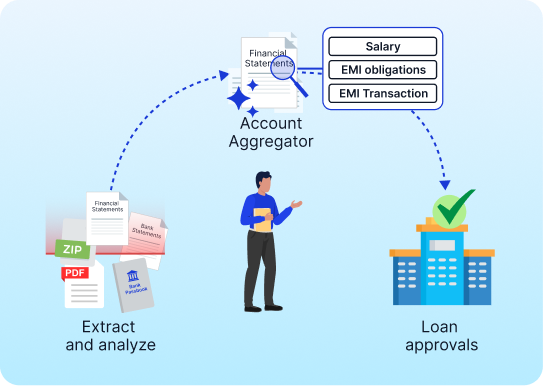

Consumer Lending BSA

Lending credit operation teams face high turnaround times due to manual review of income proofs, bank statements, and supporting documents.

- Extract and analyze borrower bank statements to assess income stability and repayment capacity

- TSP for Account Aggregator that intelligently auto-categorizes AA bank transaction data

- Detect EMI obligations, bounce patterns, income inconsistencies, and more

- Accelerate loan approvals while maintaining credit discipline

MSME Lending FSA

MSME underwriting teams struggle with manual review of financial statements, bank statements, GST data, and income–expense patterns, slowing credit decisions.

- Ingest, extract and cross-validate bank statements, financial statements, GST, invoices for credit analysis

- Analyze inflows, outflows, overdrafts, FCUs, and irregular cash movements

- Generate credit-ready customized reports and scoring system for better underwriting decisions

Lending QC Automation

As number of applicants grow, manual post-verification checks introduce inconsistencies, delays, and audit risks.

- Configure your custom QC checklist as per your lending product portfolio

- Automate QC validation across LOS data, KYC documents, income proofs, and financial records

- Detect inconsistencies and missing information instantly before loan disbursal

- Flag high-risk cases with rule-based and AI-driven checks for faster risk assessment

- Generate a complete QC summary report for every application to ensure audit-ready compliance

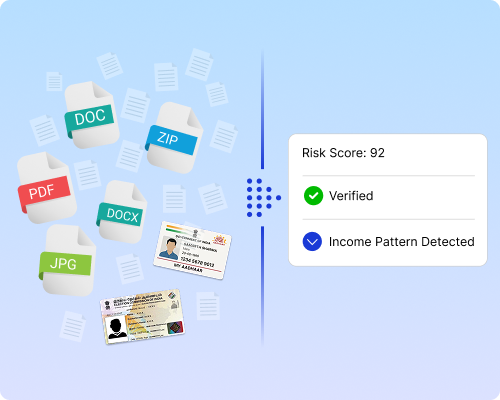

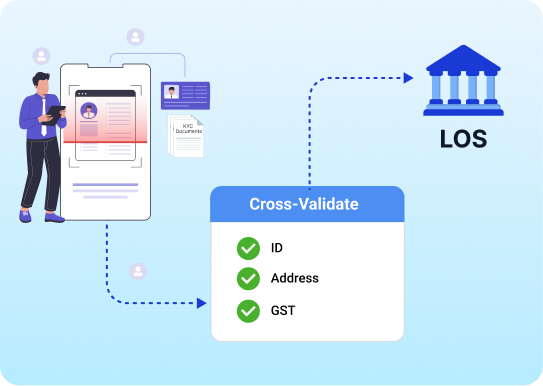

KYC Applicant Onboarding

Onboarding teams manage large volumes of applicant documents across multiple channels, often leading to rework and delays.

- Capture applicant documents from digital, assisted, and partner-led channels

- Extract and validate identity and address data with high accuracy

- Support DigiLocker integration, Aadhaar QR verification, PAN validation, and GST verification for both individuals and MSMEs

- Detect duplication, tampering, and missing documents early

- Enable straight-through onboarding into LOS and customer systems

Gold Loan Verification

Branch teams manually verify customer ID proofs, photos, signatures, and collateral documents — creating delays, errors, and bottlenecks in same-day gold loan disbursal.

- Automate capture and verification of Aadhaar, PAN, photos, and signatures

- Validate identity instantly using government APIs and AI-based fraud checks

- Digitize application, valuation, and pledge documents for consistent KYC records

- Accelerate verification and cut gold loan TAT from hours to minutes

Connect. Collaborate. Automate.

Your Automation Goals Deserve Personal Attention

Contact Info

No.10/1, Bascon Futura SV, 5th Floor,

Venkatanarayana Road, T. Nagar,

Chennai, Tamil Nadu - 600017