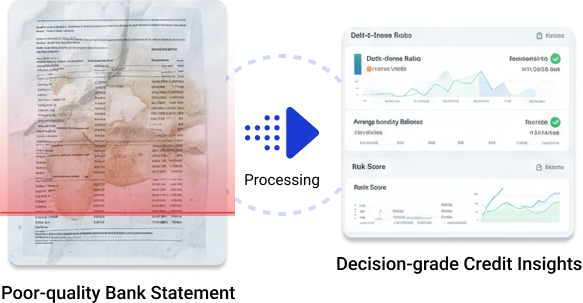

Poor-quality bank statements slowing credit decisions?

Turn even poor-quality bank statements into decision-grade credit insights in seconds. Purpose-built for BFSI and NBFC lending.

Manual Banking Solved | Faster Loan Decisions | Reduced NPA

How it works?

For Underwriting, Credit, and Lending Operations teams who need reliable borrower insights fast, without manual banking delays.

-

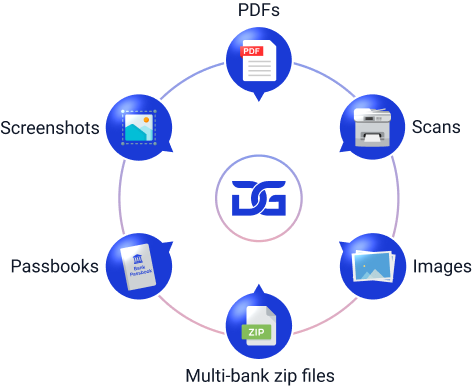

Auto-Ingest Any Bank Statement, Zero Manual Effort

DocuGenie.AI securely ingests statements from any source, any format, any quality — PDFs, scans, images, photos, passbooks, screenshots, or multi-bank ZIP files.

- Handles every bank type including cooperative, Gramin, rural & regional banks

- Multi-channel ingestion via app upload, email, SFTP, APIs & Account Aggregator

-

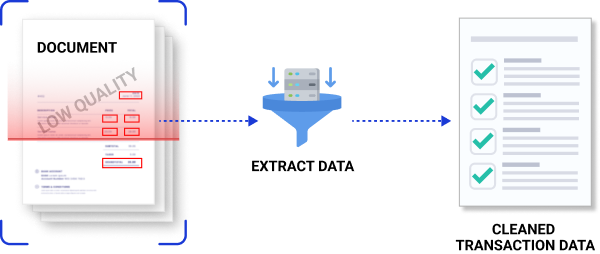

Extract, Clean & Standardize Financial Data

AI extracts every transaction, balance, narration and cashflow with industry-best accuracy, even from distorted or low-quality scans.

- Noise-resistant extraction handles distorted, skewed or handwritten inputs, shadows, blurs and low-resolution files

- Uniform standardized schema for instant use by underwriting & risk teams

-

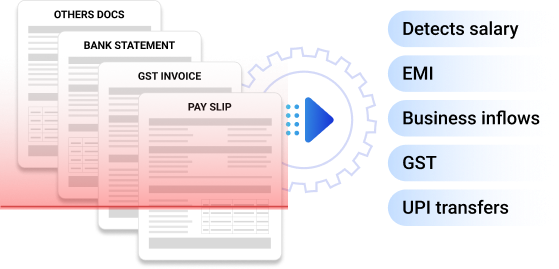

AI-Powered Categorization & Behavioural Cashflow Structuring

DocuGenie.AI’s contextual AI automatically classifies every transaction into high-fidelity financial categories, enabling accurate income assessment, fraud checks and borrower behaviour mapping.

- Advanced tagging engine detects salary, EMI, business inflows, GST, UPI transfers, wallet loads, reversals, charges, and anomalies

- Behaviour-aware cashflow modelling highlights stability, seasonality, spikes, and unusual activities

-

Advanced Analysis, Fraud Detection & Risk Flags

DocuGenie.AI surfaces hidden patterns, anomalies and behavioural risks invisible to manual review.

- Fraud signals: Tampering, round-tripping, passbook manipulation, suspicious spikes

- Behavioural analytics: Income stability, repayment discipline, liquidity patterns

-

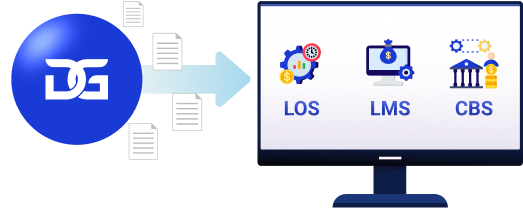

Plug-and-Play Integration with LOS & Core Systems

Structured data and insights flow directly into LOS, LMS, CBS or custom credit workflows.

- REST APIs, Webhooks & JSON connectors for instant deployment

- Enables straight-through processing (STP), reducing manual work and credit turnaround time

Why Choose Us?

0

statements analyzed

extraction accuracy

Highest Accuracy

Works perfectly even on poor scans

Smart AI Categorization

Best-in-class for salary, EMI, bounces & more

Instant Export

Reports to Excel, PDF, JSON, XML & API

Fraud Detection

Advanced PDF fraud & tampering detection

Deep Intelligence

Cashflow, CAM, and cross-document analysis

Universal Parser

Any bank format with zero training required

Core Platform Capabilities

- Best-in-Class Accuracy on Poor Scans

- Account Aggregator Integration

- Multi-Account Aggregation & Insights

- AI Fraud, Tamper & Irregularity Detection

- AI Transaction Categorization

- Auto Related-Party Detection

- Advanced Analytics & Reporting

- Instant Flexible Re-Analysis

- Customizable Reports

- Plug-and-Play AI APIs

Business Benefits That Drive Real Impact

95%+

Accuracy

80%

Analyst Time

Saved

5x

Faster Credit

Decisions

1,500+

Bank templates

supported

Lightweight and scalable architecture designed to run seamlessly across environments.

Who Can Benefit?

Lending organizations that require speed, accuracy, and risk visibility across diverse borrower profiles and bank formats.

Banks

Automate borrower bank statement analysis across all banks, including cooperative and Gramin, for faster, consistent credit decisions.

NBFCs & Digital Lenders

Scale high-volume lending by eliminating manual banking, improving fraud detection, and accelerating credit approvals.

FinTech & Embedded Lending

Enable API-driven bank statement analysis for real-time credit decisions with seamless LOS and risk engine integration.

Microfinance & Rural Lending

Digitize passbooks and cooperative bank records to improve accuracy, reduce verification time, and enable compliant rural lending.

Data Security is Our Promise

Trusted by Banking & Financial Services, Logistics, Manufacturing, E-commerce, and FinTech enterprises, DocuGenie.AI™ is built with enterprise-grade security at its core. Whether deployed on-premises or in the cloud, your data remains protected, private, and compliant with ISO standards, India DPDP Act, and GDPR.

Seamless Plug & Play

Lightning-fast deployment with zero infrastructure cost. No rip-and-replace required. DocuGenie.AI™ connects every document and workflow instantly.