Manual KYC QC slowing activations across high-volume digital onboarding?

Orchestrate automated KYC quality control with custom checklists across LOS, CRM, and onboarding platforms.

Consistent QC | Seamless Integration | Faster Customer Activation

How it works?

For Compliance and Operations teams to run audit-ready KYC QC at scale without slowing digital onboarding.

-

Auto-Ingest: Any Document, Any Source

DocuGenie.AI ingests high-volume, high-variance documents that usually break traditional QC systems — regardless of how or where they originate.

- Vendor onboarding packs, KYC bundles, contracts, invoices, PODs, bank statements, HR forms, compliance filings

- Customer uploads, field-agent photos, WhatsApp/email attachments, partner portals, batch ZIPs & system feeds

-

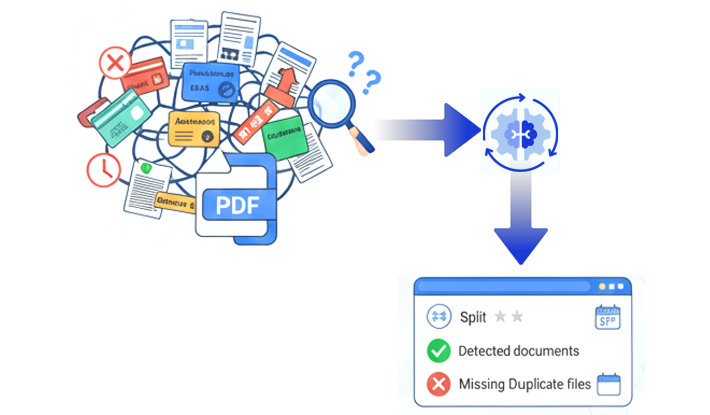

AI-Based Document Identification

DocuGenie.AI uniquely understands real-world document chaos — mixed bundles, repeated pages, partial submissions, & incorrect uploads, without relying on naming rules.

- Aadhaar, PAN, Invoices, PO, GRN, offer letters, payslips, certificates, declarations & annexures

- Auto-splits multi-doc PDFs & detects missing, duplicate, or irrelevant documents

-

Context-Aware Data Extraction

DocuGenie.AI extracts the right data for the right process, even when formats vary across vendors, geographies, or departments.

- Identity fields, financial values, dates, signatures, stamps, clauses, line items & reference numbers

- Handles handwritten entries, stamps-over-text, low-resolution scans & vernacular documents

-

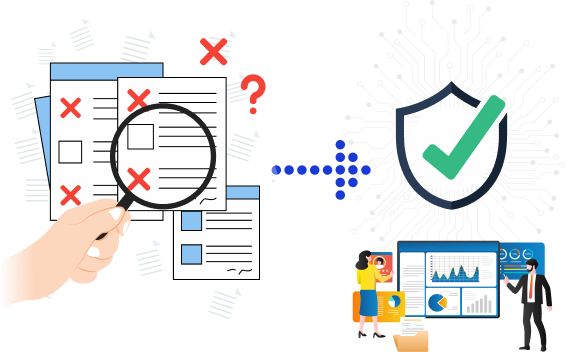

Checklist-Driven QC Validation

DocuGenie.AI's biggest differentiator: process-aware QC, not static rules — enabling checklist validation exactly how business teams think.

- Vendor compliance checks, onboarding QC, lending QC, HR verification, invoice & POD validation

- Cross-document consistency, mandatory field checks, expiry validation & exception-only human review

-

Straight-Through System Integration

DocuGenie.AI closes the loop by pushing QC-approved outcomes, not raw data — enabling automation across downstream systems.

- Vendor Masters, LOS, ERP, HRMS, CRM, finance & compliance platforms

- Full audit trail, QC status, exception reasons & reviewer actions

Why Choose Us?

0

pages processed

extraction accuracy

Checklist-First Architecture

Built for QC workflows, not generic extraction model

Process-Aware AI

Understands context, not just fields

Real-World Document Resilience

Performs on messy, low-quality inputs

Exception-Only Human Review

Humans engaged only when AI flags risk

Enterprise-Grade Auditability

Full traceability for every QC decision

Universal QC Engine

Any document, any checklist, zero retraining

Core Platform Capabilities

- Checklist-Driven QC Engine

- Adaptive AI for Any Document

- Context-Aware Field Validation

- Cross-Document Consistency Checks

- Tamper, Forgery & Authenticity Detection

- Low-Quality & Handwritten Document Resilience

- End-to-End Audit Trails & Explainability

- Real-Time Exception Prioritization

- Dynamic Workflow Automation

- Plug-and-Play Enterprise APIs

Business Benefits That Drive Real Impact

3–5x

Faster Processing

& Approvals

80–90%

Reduction in

Manual QC Effort

99%+

Reliable QC

Outcomes Across Docs

Zero

Blind Spots

End-to-End Auditability

& Exception Tracking

Lightweight, scalable architecture built to run seamlessly across environments.

Who Can Benefit?

Purpose-built for regulated and high-volume onboarding environments that require consistent KYC quality control without impacting activation speed.

Banking & Financial Institutes

Automate document QC for onboarding, lending, and compliance. Reduce errors and accelerate approvals at scale.

Logistics & Supply Chain

Validate PODs, invoices, and bills automatically. Reduce disputes and speed invoice clearance.

Manufacturing

QC vendor, procurement, and production documents to maintain accuracy and speed approvals.

Quick Commerce

Streamline driver-partner onboarding and documentation checks for faster activation.

Real Estate

Automate QC of property, lease, and legal documents for faster approvals and compliant transactions.

Staffing & HR

Automate verification of employee documents and onboarding forms. Reduce manual review and ensure compliance.

Data Security is Our Promise

Trusted by Banking & Financial Services, Logistics, Manufacturing, E-commerce, and FinTech enterprises, DocuGenie.AI™ is built with enterprise-grade security at its core. Whether deployed on-premises or in the cloud, your data remains protected, private, and compliant with ISO standards, India DPDP Act, and GDPR.

Seamless Plug & Play

Lightning-fast deployment with zero infrastructure cost. No rip-and-replace required. DocuGenie.AI™ connects every document and workflow instantly.