PROVEN METRICS ACROSS INDUSTRIES

See Operational Impact within

1 Week

90%

Less Manual Effort

500%

Higher Operational Efficiency

4x

Return on Investment

DocuGenie.AITM Flagship Products

Bank Statement Analyzer

Analyzes bank, financial statements to predict credit risk assessments.

Learn More

KYC QC Automation

Automates onboarding with custom KYC QC checklists built for scale and compliance.

Learn More

Unlock Industries Best Practices with DocuGenie.AITM

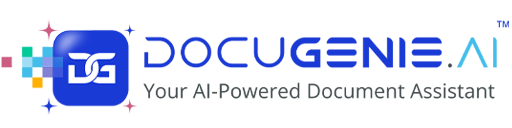

Banking & NBFC

Accelerate Credit Decisions. Minimize Underwriting Risk.

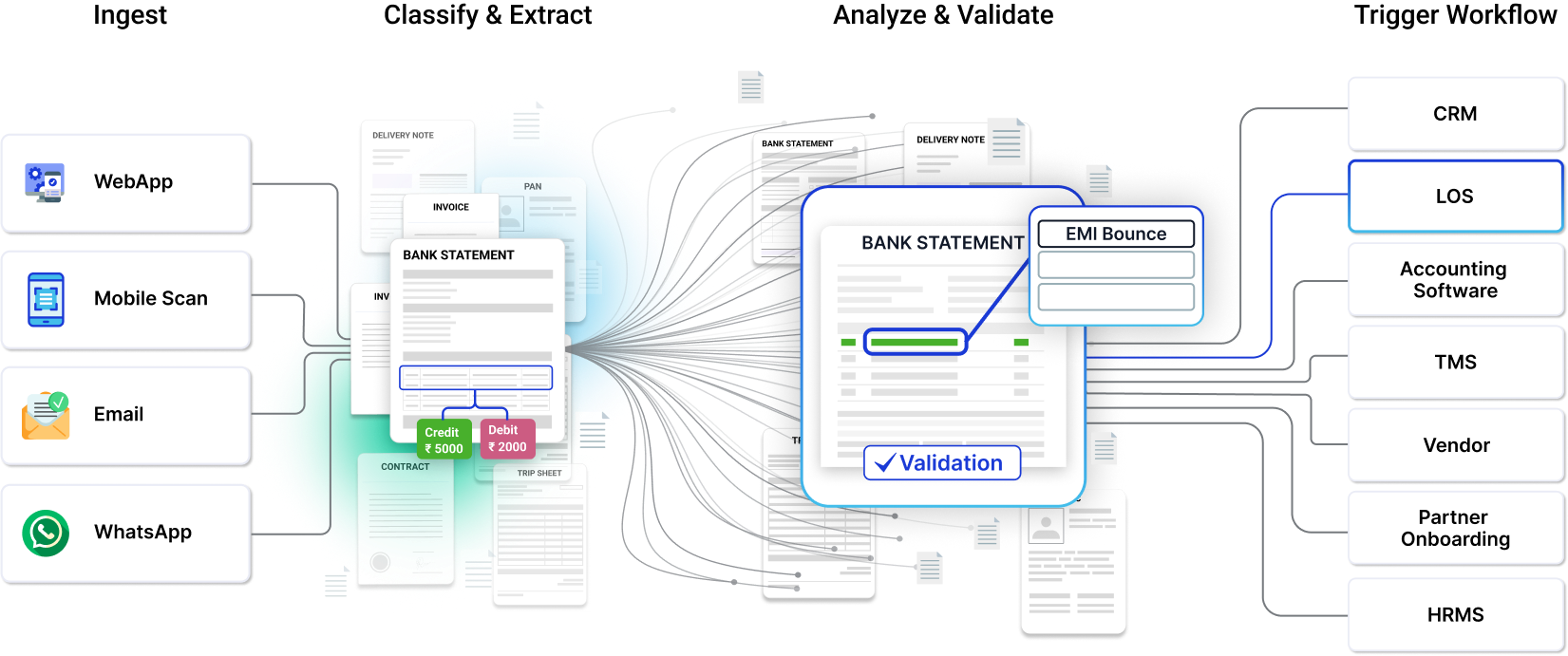

Auto-ingest bank statements, financial statements, income proofs, KYC, company specific forms, and more at scale.

Identifies documents and extracts key data accurately, even from poor-quality scans. Also, capable of integrating with Account Aggregators (AA).

Categorizes each transaction intelligently for credit risk analysis.

Detects FCUs, fraud patterns, income trends, payment bounce, and credit score in real time for underwriting.

Automates lending QC by verifying KYC, income proofs, and other documents, while leveraging LOS data to streamline QC and minimize risk.

Easily plug DocuGenie.AITM into your LOS or core banking systems to scale lending operations.

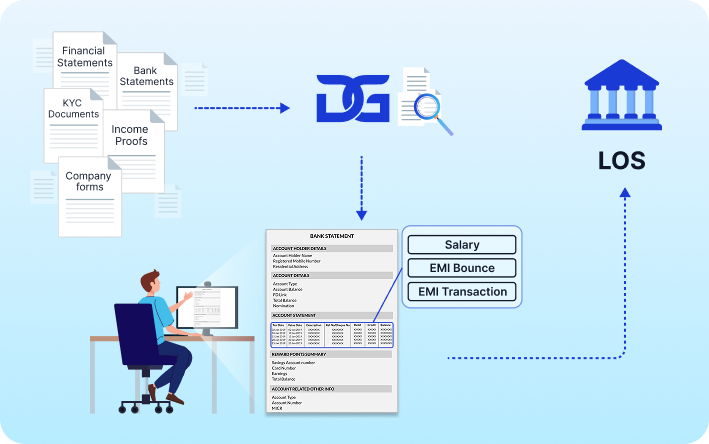

Logistics & Supply Chain

Accelerate Billing. Automate PODs End-to-End.

PODs, trip sheets, LR discrepancies, e-Way bills, invoices, and vendor KYC documents from hubs and field teams.

Auto-classifies and extracts shipment details, delivery exceptions, signatures, and timestamps with high accuracy.

Recognizes delivery details, shortages, damages, and handwritten notes on stamped or annotated documents.

Automates exception workflows, enabling faster resolution and fewer billing disputes.

Syncs decision-grade data into TMS, ERP, and billing systems for real-time visibility across hubs.

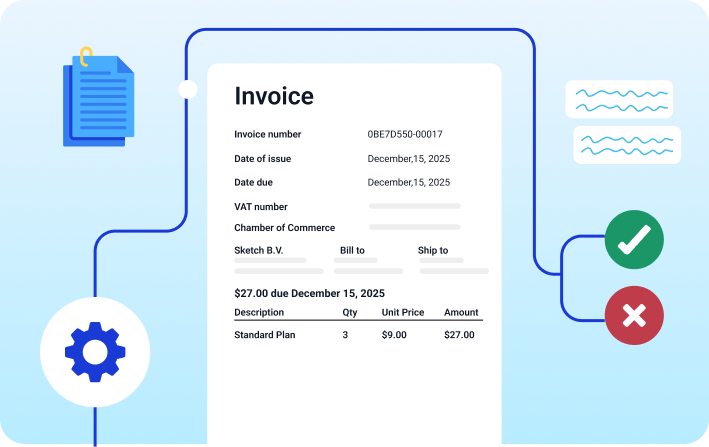

Manufacturing

Automate Invoices. Eliminate Match Errors.

Ingests and extracts AP Invoice, AR PO details with high accuracy.

Matches master part lists and validates part codes, pricing, quantities, and vendor details.

Performs 2-Way and 3-Way matching across Invoices, POs, and GRNs to flag discrepancies instantly.

Syncs validated data into accounting or ERP systems to accelerate AP/AR cycles and reduce manual workload.

One Engine

5 Intelligent Steps

The DocuGenie.AITM Advantage

-

Highest Accuracy on Poor-Quality Scans

Handles blurry images, skewed scans, handwritten documents, and screenshots better than any engine in the market.

-

Industry Deep Intelligence

Built-in domain expertise accelerates Banking & Financial Services, Logistics, Manufacturing, E-commerce, and Fintech use cases.

-

Zero-Training Model

Customizes instantly without long training cycles, enabling rapid deployment.

-

Plug-and-Play Integrations

Easily integrates with ERPs, LOS, CRMs, and cloud-based systems.

-

Chat with Knowledgebase

Search, query, and interpret documents with conversational intelligence.

-

Multi-Language Support

Understands and processes documents in multiple regional and global languages.

Data Security is Our Promise

Trusted by Banking & Financial Services, Logistics, Manufacturing, E-commerce, and FinTech enterprises, DocuGenie.AITM is built with enterprise-grade security at its core. Whether deployed on-premises or in the cloud, your data remains protected, private, and compliant with ISO standards, India DPDP Act, and GDPR.

Seamless Plug & Play

Lightning-fast deployment with zero infrastructure cost. No rip-and-replace required. DocuGenie.AITM connects every document and workflow instantly.

DocuGenie.AITM in Action

High-Volume Logistics Operations

"Manual POD reconciliation delayed billing cycles.

Learn how DocuGenie.AITM delivered 70% faster closures with 98% accuracy."

Fintech Payments Company

"Manual KYC reviews were limiting onboarding speed at scale.

See how DocuGenie.AITM automated merchant KYC with audit-ready accuracy."

Leading Manufacturing Enterprise

"Multi-vendor invoices slowed financial closures.

See how DocuGenie.AITM automated invoice validation & 3-Way matching."

Leading Housing Finance Enterprise

"High-volume bank statement processing caused bottlenecks.

DocuGenie.AITM automated extraction & risk insights."

Automate What Slows You Down

Automate document workflows, digital onboarding, credit underwriting, and more - all from one unified engine. Enhance accuracy, speed, and operational scale across teams.

Contact Info

No.10/1, Bascon Futura SV, 5th Floor,

Venkatanarayana Road, T. Nagar,

Chennai, Tamil Nadu - 600017